Changes for Business Grants to Help More Australian Businesses

Amid COVID-19 and any crises, businesses should be able to prepare and plan out how to deal with the post-events, especially when such cases threatened business’ stability and economic growth.

To help businesses many government grants have been developed in response to perceived specific needs of businesses. However, there’s a need to break down the complexities of these programs that can be expensive and show questionable return to business, government and taxpayers. We’ve created a comprehensive solution to further these funding towards helping businesses better know their options when it comes to government funding.

Rationalise All Government Business Grants Programs

Replacement of all Commonwealth and state grants with a tax incentive-based approach that would create an incentive for growing small to medium-sized Australian businesses. This is a much better way to aid assistance rather than business grants which are too selective and are both expensive to administer and apply.

To target smaller businesses, this incentive approach should be limited to companies with less than $20 million turnover.

The tax incentive areas should become:

1. R&D – Research and Development – Incentive – projects with defined commercialisation activities (as currently exists).

2. Commercialisation Investment Incentive – projects with defined (early stage) commercialisation activities.

3. International business Incentive – Export or global expansion – projects with defined international marketing activities.

The new approach would provide tax incentives; in preference to grants. It would be based, like the R&D Tax Incentive, on projects that are properly defined in the following areas:

1. R&D Tax Incentive

Eligible Projects/activities and expenditure in R&D should remain, as currently defined. R&D is currently described and structured as core and supporting activities within specific projects.

2. Commercialisation Tax Incentive

Eligible Projects/activities and expenditure in Commercialisation would cover those things to commercialise, such as: identifying customers and markets, producing business plans or strategies, branding and promotional activities, and securing the initial clients or markets. Commercialisation requires planning and follows projects and activities. This program is designed to help leverage private investment in early-stage or start-up businesses.

3. Export Marketing Tax Incentive

Eligible Projects/activities and expenditure in international marketing may generally follow the activities currently defined in the Austrade, Export Market Development Grant (EMDG) program. However, these should also be re-defined as activities within specifically planned export projects.

Export Marketing Tax Incentive Revamped

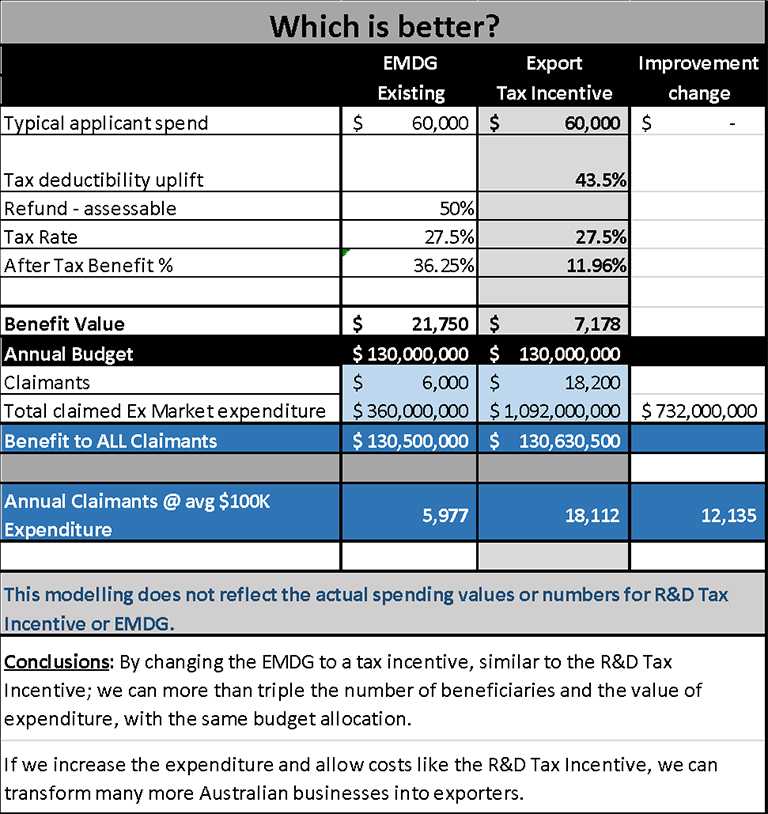

The EMDG can become more efficient, more effective, more accessible, and more valuable; if it is re-engineered as shown below:

If the EMDG were transformed into a refundable tax incentive program, similar to the R&D Tax Incentive, there would be a much larger amount of export marketing expenditure that can be subsidised and there could be many more companies that can access the program.

Exports Should Become a Part of Many More Australian Businesses

From the table above; it would be possible to triple the number of participants with a similar budget spend. The amount of grant funded export expenditure also triple. This is because the after-tax benefit will be reduced from 36% of expenditure to 12%. There would then be scope to make the Export Marketing Incentive (EMI) program much more open and accessible; while reducing the compliance burden.

The following adjustments should be made to the current Export Marketing Grant:

1. Tax Incentive

Change the program from being an assessable grant to being a tax incentive.

This would change the net, after-tax benefit to exporters from 35% to 13.5% with adjusted tax rates, allowing for much more expenditure to be subsidised by the same budget allocation.

2. Better Targeting

Target the grant more effectively by limiting total business income to $20 Million, the same threshold as the refundable R&D Tax Incentive. This would limit the program to smaller companies, allowing it to be used more for new international ventures.

3. Program – Project structure

The export grant is currently not based on defined projects and planned activities. That aspect should be updated for the new export tax incentive. Change the program to help businesses to achieve effective, planned, and structured export marketing by defining export projects that would include defined export projects and activities.

4. Simplified expenditure categories

To make the grant more accessible, more understandable and more effective, the export marketing expenditure categories should be simplified, with the categories limited to:

-

Export Marketing Consulting – Market Research and Marketing Planning.

-

Export Market Representation – Marketing Retainer and costs.

-

Export Travel – Airfares and accommodation costs.

-

Export Trade Fairs and Events – Costs to trade fairs organisers and other promotional expenses.

-

Export Advertising and Export Promotional Material – Costs of advertising in various media.

-

Arbitrary expenditure limits previously applied to categories should be eliminated.

Expenditure should be strictly limited to recipients that are Australian companies, individuals, and contractors – including overseas representation and marketing consultants.

5. Export Income Limits

The export sales performance limits placed on export grants are an attempt to limit the payment of the grant. This would not be necessary if the program became a rebatable tax incentive because it would then be more self-limiting:

-

When companies are in a tax loss scenario, they are effectively using up tax losses and Future Tax Benefits so the benefit is limited to 13.5%, after-tax.

-

As companies become profitable, they are limited in the returns they receive to a tax offset – again equivalent to 13.5%.

By placing a $20M income limit on companies for eligibility that will further reduce demand and negate the need for export sales performance tests.

6. Cash Basis of expenditure and Income

The cash basis of expenditure is another issue that limits and complicates the EMDG. In the R&D Tax Incentive, that is not a requirement (except for associated party payments) and works because of the rebatable tax losses.

7. Austrade linked networks assistance

The effort currently applied by Austrade for administration and compliance of the EMDG should be reshaped to assistance through the international networks of trade commissioners and foreign-based Australian trade representatives. The effectiveness could also be improved by removing the limitation rules on expense categories.

By having only 12%, net after-tax, benefit, ensuring rules-based entitlement, and opening up the program to much wider appeal to drive the export of Australian Business; the new Export Marketing Incentive can become a more significant boost to the economy.

Changing the Export Grant into a Tax Incentive will change the focus. It will be more about incentive and less about compliance. It could become a potential employment driver – as is the R&D Tax Incentive. Expenditure made on employing Australian Business and Marketing expertise, both at arm’s length and with employment roles in claimant companies, will bring employment of marketing expertise and grow Australian Business.